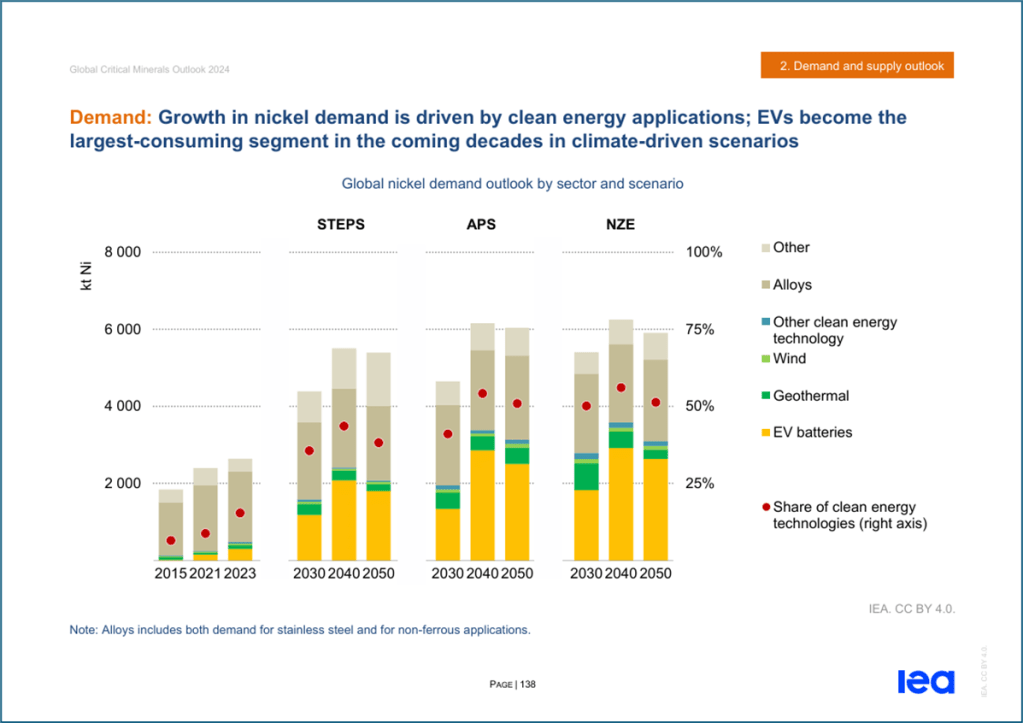

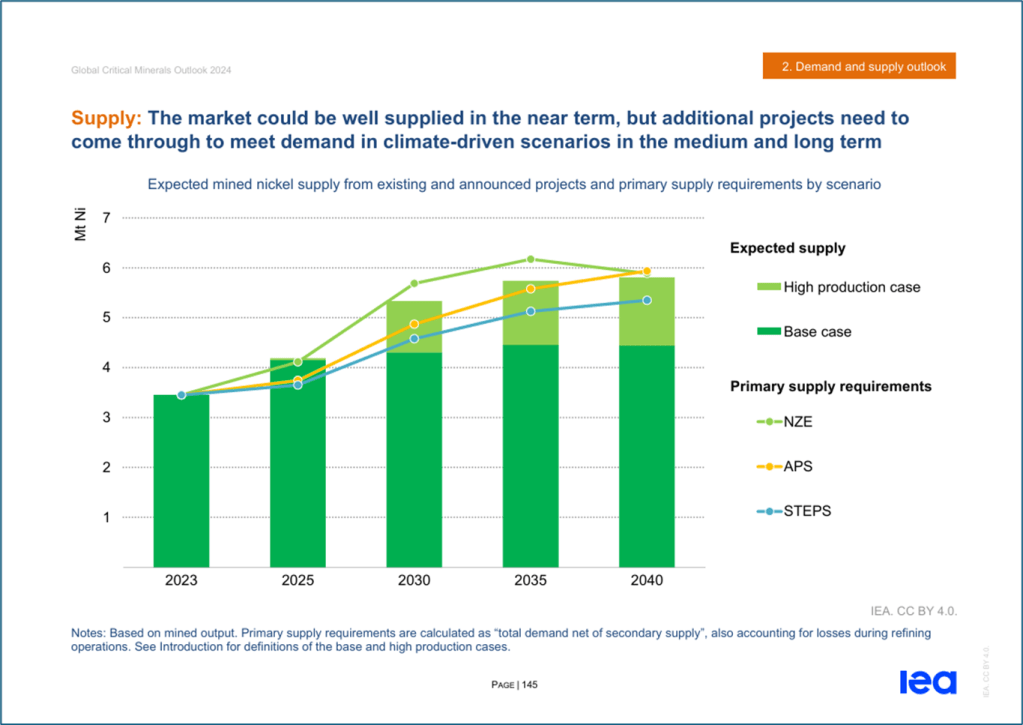

Projected increasing demand is expected to lead to a shortfall of supply, despite the development of some large new mining and extraction projects. Figs. 3 and 4 show the International Energy Agency (IEA)s projection of supply, demand and the expected supply gap.

Fig. 3 International Energy Agency[1]: Estimates of Nickel Demand.

STEPS = current policies

APS = meets national climate goals in full

NZE = Net Zero Emissions by 2050

Fig. 4 International Energy Agency[1]: Estimates of Nickel Supply and Demand.

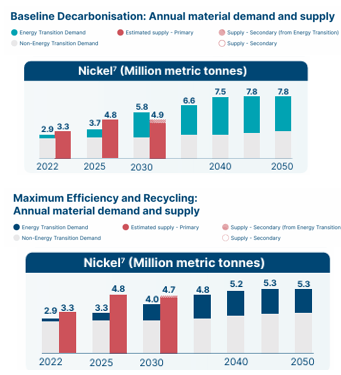

Fig. 5 shows scenarios considered by the Energy Transition Commission (ETC) and their projection of supply, demand, and the possible supply gap. Both studies show a need for the investment of tens of billions of dollars in new primary production of nickel, and also in plants for recycling LIBs to produce secondary Nickel and other metals.

Fig. 5 Energy Transition Commission [3]: Estimates of Nickel Supply and Demand

Both studies also consider that evolving battery technology may be used to mitigate shortages and high prices of Nickel. Manufacturers may select Ni-free LIB designs which generally have lower energy density than LIBs with Ni based cathodes. That infers reduced EV range which makes them less attractive, as does higher EV price due to high Nickel price.

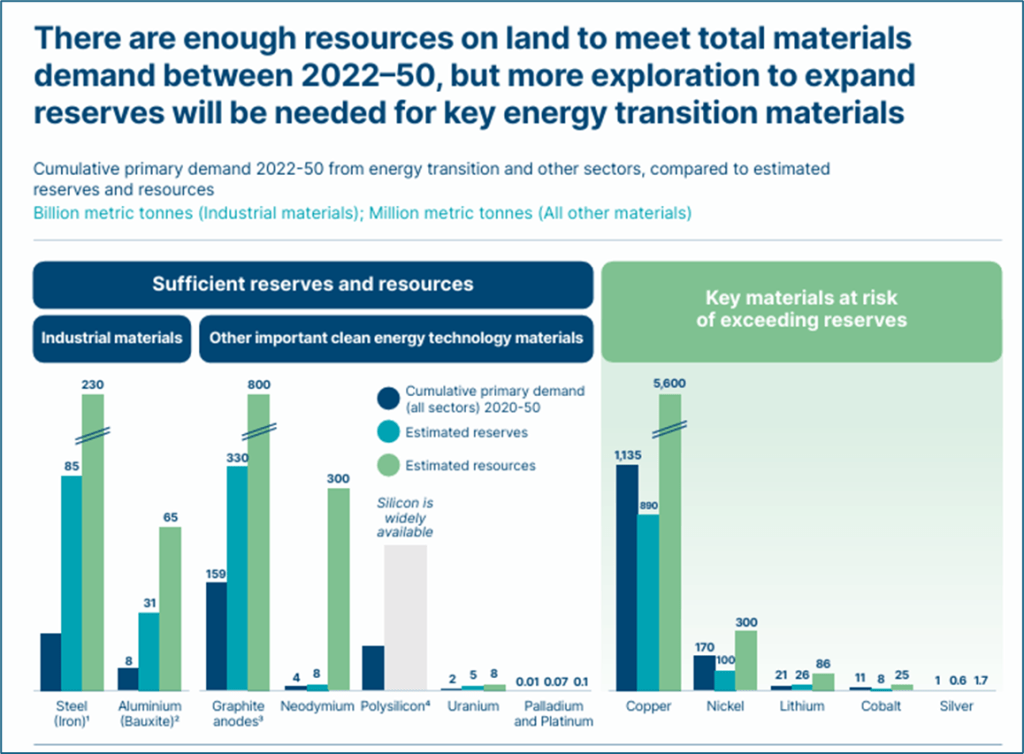

The ETC report also identifies (see Fig 6) Nickel as a case in which future supply may be constrained by available reserves.

Fig. 6 Energy Transition Commission[3]: Cumulative Ni Demand vs Reserves