However, I think that both the IEA and ETC studies may be underestimating the future demand for Primary Nickel for stainless steels (STS) and other alloys. Sources focussed on the STS industry predict robust continuing growth, at compound annual growth rates (CAGR) ranging from 3% to 7%. I have made some rough calculations assuming STS CAGR = 5%.

In 2024, 65% of the Primary Nickel production, ~2.4 Million Tonnes, was used in the production of 60 Million Tonnes of STS melt shop output. That is Primary Nickel was ~ 4% of STS melt output.

If we assume a constant rate of Primary Nickel content and apply CAGR = 5%, we will need 4.1 Million Tonnes of Primary Nickel to make 100 Million Tonnes of STS in 2035. Then we will need 5.2 Million Tonnes of Primary Nickel in 2040 and 8.5 Million Tonnes in 2050. The much lower IEA projections (see Fig. 3) for Ni in Alloys is based on expectation of greatly increased recycling of STS in China and other Asian countries as the STS flow ex-service increases, and also of lower growth in STS production.

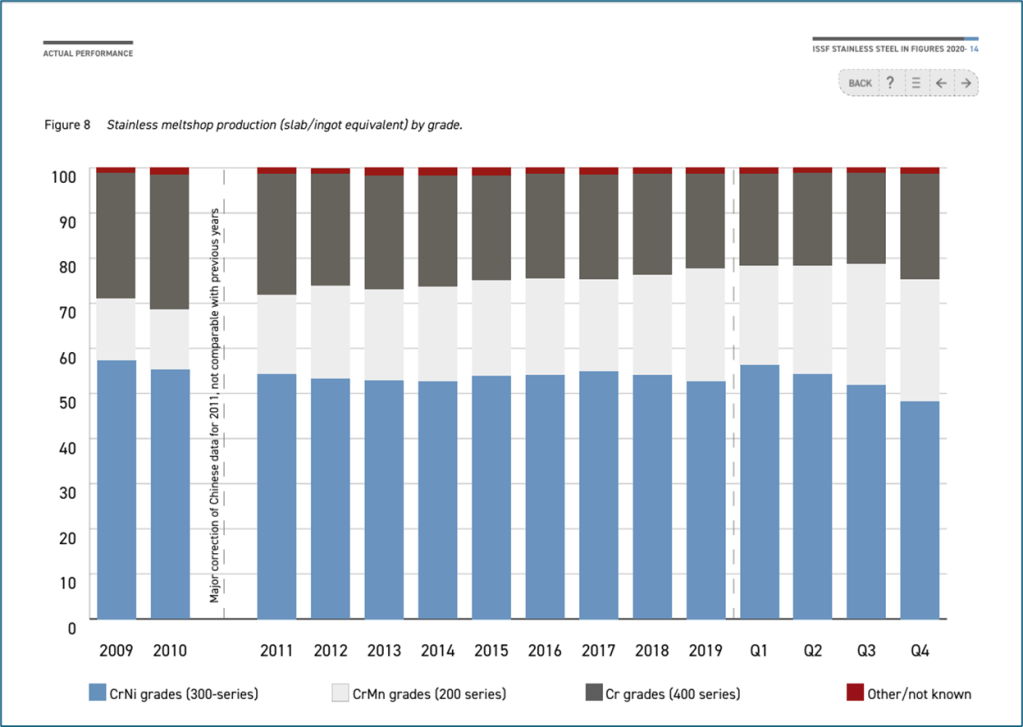

The global percentage of Ni in STS is affected by both the mix of STS grades produced, and by the incorporation of Ni bearing scrap. The original stainless steel contained 18% Chromium, for corrosion resistance, and 8% Nickel to stabilise the austenitic structure which gave desirable mechanical properties. That was the basis of the ‘300 Series’ austenitic STS which have 8 to 12% Ni. Now we have at hundreds of grades of stainless steels. The 400 Series ferritic STS typically have <1% Ni, and volatility in the Ni price has driven companies such as IKEA [5] to make a sustained effort to change from 300 Series to 400 Series STS for applications in benign household environments. The World Stainless Association has pointed out[5] that 400 Series STS with enhanced corrosion resistance are available which can replace 300 Series STS in most environments at ambient temperatures (see Fig.7). Where the mechanical characteristics of austenitic STS are required, 200 Series STS containing 3 to 6% Ni are available. These contain enough Mn and N to stabilize the austenitic structure. Fig. 8 shows the evolving mix of grades in global STS production. In China and other Asian countries where STS production is growing fastest, 400 Series and 200 Series are preferred but incorporation of recycled scrap is at a low rate because the material in service is not old enough to generate a lot of ex-service scrap. In Europe and North America, 300 Series STS continue to predominate, and the scrap incorporation rate is high, although it is a mix of STS and mild steels. The preference for 300 Series STS appears to be an example of market inertia due to consumer expectations; embedded specifications and part drawings; scrap availability and supply chain stocking practices.

Fig. 7 International Stainless Steel Forum: Ferritic / Austenitic Localised Corrosion Resistance

Fig. 8 ISSF [6]: Evolving Mix Of Stainless Steel Grades

References

[5] ‘’The Ferritic Solution: Properties / Advantages / Applications’’ pub April 2007, International Stainless Steel Forum (now World Stainless Association).

[6] ‘’Stainless Steel in Figures 2020’’, International Stainless Steel Forum (now World Stainless Association).